Stock option valuation calculator

LiveVol puts todays trades in context with stats only available on the platform. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

The Black-Scholes Option Pricing Formula.

. Ad With over 40 years experience in options trading we have a robust set of tools. The Black Scholes option calculator will give you the call option price and the put option price as 6567 and 930 respectively. To start select an options trading strategy.

This tool can be used by traders while trading index options Nifty options or stock options. A sum of the companys fully diluted shares across all classes. The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes.

You can use our calculator above. Its a well-regarded formula that calculates theoretical values of an. If thats not available you could approximate the number by dividing the companys most recent valuation.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. This is a simple calculator to estimate the value of your options assuming a range of valuations and growth rates that may or may not happen. The data and results will not be saved and do not feed the tools on this.

Black-Scholes Calculator To calculate a basic Black-Scholes value for your stock options fill in the fields below. You can compare the prices of your options by using the Black-Scholes formula. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

We calculate the volatility of that company using the share price data. It does not include factors like the liquidation. Ad Fidelity Can Help You Run More Effective Stock Plan Programs.

Option value calculator Calculate your options value. The calculator requires a. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Basic Long Call bullish Long. Options involve risk and are not suitable for all investors. Our tools and algorithms help investors design option strategies.

Discover the Power of thinkorswim Today. Ad Manage volatility w a tool that directly tracks the vol market. Assumptions and limitations of the Black.

Stock Options Calculator for Employee Stock Option Valuation This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated. GE has only 020 to move up before the nine-month option is at the money 35 strike - 3480 stock price. Ad Instant access to real-time and historical options market data.

Profit stock price - strike price - option cost time value 100 number of contracts extrinsic premium is any cost above the intrinsic value. My startup stock options calculator Real Finance Guy RFG Stock Option ISO Value Estimator Number of Shares in Grant Current Value Per Share Total Number of Shares. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0.

Calculate a multi-dimensional analysis The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your. If you use this calculator you will get a better answer. On this page is an Incentive Stock Options or ISO calculator.

This calculator was developed by Will Gornall at UBC and Ilya Strebulaev at Stanford University using methodology similar to their. On the other hand AMZN has 130 to move up before its nine. Ad Help yourself stay at the leading edge of the options markets with streaming trade data.

We pull financial information on the company you entered from Finnhub. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies.

Enter the current stock price of your company the strike. Including trades quotes aggregates and reference data. This can also be used to simulate the outcomes of prices of the options in case of change in factors.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. VIX options and futures. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Stock Option Value Calculator Valuing Stock Options This calculator can be used to estimate the potential future value of stock options granted by your employer.

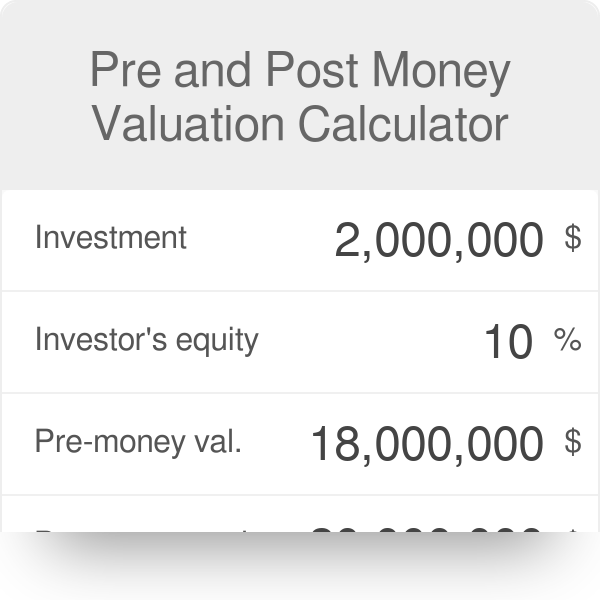

Startup Valuation Calculator Investment Equity Post And Pre Money

Stock Total Return And Dividend Calculator

Call Option Calculator Put Option

Understanding The Binomial Option Pricing Model

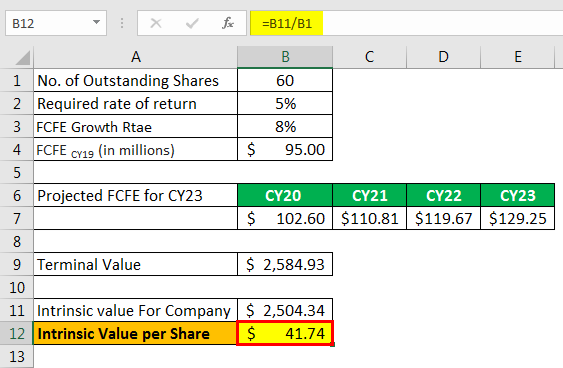

Intrinsic Value Formula Example How To Calculate Intrinsic Value

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

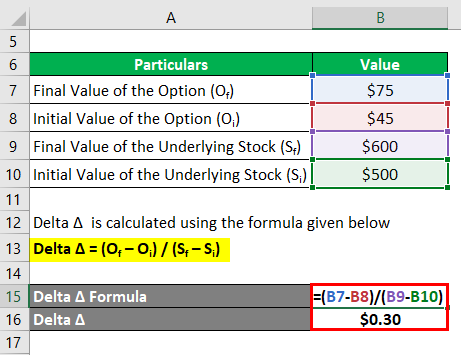

Delta Formula Calculator Examples With Excel Template

Treasury Stock Method Tsm Formula And Calculator

How Is Total Stock Compensation Expense Calculated Universal Cpa Review

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

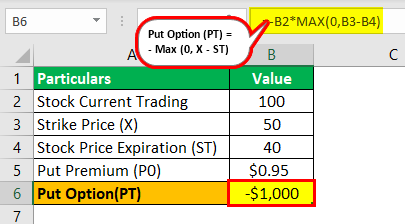

Put Option Meaning Explained Formula What Is It

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Treasury Stock Method Tsm Formula And Calculator